In my 20+ years in supply chain management, I’ve seen many companies struggle with freight audit and payment. The process is often slow, complex, and full of errors. Fragmented systems, lack of visibility and transparency and manual steps present challenges in validating even the simplest line-haul and fuel charges, let alone more complex demurrage and customs clearance charges. These challenges can result in overcharges, fraud and delayed payments.

This guide is for supply chain leaders, CFOs, and logistics managers who want better control over freight costs. I’ll explain how freight audit and payment work, why the old way fails, and what modern tools can do to help.

What is Freight Audit and Payment (FAP)

Freight audit and payment (FAP) is the process of checking and paying shipping invoices. Traditional providers like US Bank and Cass Information Systems handle this after a shipment is complete. They compare invoices with paperwork to find mistakes.

Here’s how the typical process works:

- Shipment completion: The goods are delivered and validated by Proof of Delivery

- Invoice receipt: Carriers send their invoices to the FAP platform via EDI, PDF, portal, or email

- Document collection: You gather bills of lading, delivery receipts, and more for the system to check duplicates, formats and required fields

- Automated or Manual review: While legacy FAP providers may have automated audits, their technology will be dated and cannot compare to today’s AI agents. Often, they require someone to compare the documents and try to match the carriers’ data with the shippers

- Dispute identification: Discrepancies can trigger Auto-disputes sent to the carrier or internal routing to logistics/AP teams

- Resolution process: Time is spent resolving discrepancies

- Payment processing: Approved invoices are paid typically via integrations to ERP/finance systems

This process is slow and reactive. Accessorial and orther discrepancies are often identified after the fact, often weeks later, when addressing them is more difficult. And the root cause is never really addressed.

Upgrade your freight audit solution to a perfect invoice. Reduce overpayments, minimize the risks of fraud, and save time with KNNX’s Enterprise Assurance Transaction Platform.

Why Freight Audit and Payment is Important

Freight costs are a big part of your budget. In the U.S., over $140 billion in freight invoices are disputed each year. Without proper checks, your company risks:

- Losing money: Overcharges, duplicates, and fraud can cost you 5–15% of your total shipping spend.

- Wasting time: Manual reviews take teams from both the shipper and carrier away from more important work. Disputes can drag on for months.

- Hurting cash flow: Unresolved charges and delayed payments impact DSO

- Financial reporting: G/L coding and accruals are impacted by the reconciliation delays.

- Damaging carrier relationships: Disputes strain trust and make rate negotiations harder.

- Risking compliance: Bad and disconnected data exposes the organization to audit and legal risks.

Why Freight Invoicing & Auditing is Challenging

Managing supply chains and the logistics to get a product into the hands of a consumer has always been complex and challenging. In today’s world of global supply chains, geopolitical influences, and consumer demands to deliver it to their doorstep, the complexity and challenge has increased. Here are a few factors that impact the submission and approval decision on a freight invoice:

Volume

For every shipment, there is a corresponding invoice. Shippers often have multiple distribution centres (their own, or operated by a 3PL), and many stores. They usually will have a primary transportation provider along with secondary carriers, so in a single week, they could be receiving 1,000s of invoices for shipments. Added to this are 200+ attributes per shipment that need to be tracked. Then, if they are doing any sort of eCommerce, they could have 100s of thousands of deliveries to track and pay for weekly.

Complexity and Variety

A typical logistics plan will have multiple modes of transportation: Ocean containers, Air shipments, Intermodal Rail and Over The Road (OTR), and then finally Last Mile deliveries for eCommerce. They may be using the Full Container or Truckload, or Less than Container or Truckload. The commodity being shipped could require HAZMAT, heat, or refrigerated equipment.

For each one of these scenarios, there is a contract rule determining how to bill. In this list of scenarios above, we haven’t even talked about Accessorial Charges yet; how will fuel surcharges, demurrage, detention, off-route, wait-times, reweighs and many more, depending on the type of shipment, be calculated and billed.

Documentation and “Proof” Requirements

Beyond providing a copy of the completed BOL, there may be many more documents or materials required from the carrier to allow a smooth approval of charges to occur. These can come in the form of .pdfs submitted with the invoice for reweighs, customs documents, in/out timestamps at every location along the journey, even pictures to show no damages. Reviewing these materials in an automated fashion can be challenging without the latest technologies.

Getting the Data Right

There is a tendency to blame the transportation carriers for a lack of, or incorrect data. But let’s face it, the shippers are not perfect either. Having technology to tender a shipment to a carrier in the format they need to receive it can be a challenge for shippers. With the variety and complexity we’ve described here, having experienced operators tendering it correctly to carriers (ie. the correct mode, equipment, even the preferred carrier for this lane) is a challenge that impacts their operations, efficiency, and ultimately their relationships with carriers.

Top 12 Freight Audit and Payment Solutions

Freight audit and payment solutions have their limitations. However, these are the best options in 2025, based on a review of the industry:

Trax Technologies

A platform for large companies that want to cut freight costs with strong reporting and data tools.

Best for: Mid-to-large companies needing detailed analytics across carriers.

Pros:

- Deep reporting and analytics

- Supports all transport modes

- Works with major TMS platforms

- Strong reputation

Cons:

- Checks invoices after shipping

- Not built for real-time validation

- Takes time to set up

- Can be costly for small teams

enVista

A mix of software and consulting for companies wanting both tools and expert advice.

Best for: Enterprises that want software plus consulting help.

Pros:

- Offers both tech and strategy

- Handles complex logistics

- Good implementation support

- Deep industry knowledge

Cons:

- Higher total cost

- Longer setup time

- Too much for companies wanting software only

- Still a reactive system

Intelligent Audit

An AI-powered system for companies with many shipping methods and carriers.

Best for: Companies using many transport modes who want automation.

Pros:

- Uses AI to review invoices

- Handles parcel, LTL, FTL, ocean, air

- Trusted by 2,500+ clients

- Detects duplicate invoices automatically

Cons:

- Audits after shipping

- Limited in stopping errors before they happen

- Misses some edge cases without deeper data

- Disputes still take time

Cass Information Systems

A long-standing provider that handles large volumes with strong security.

Best for: Large shippers needing stable, secure processes.

Pros:

- 100+ years in the business

- Bank-level security

- Can handle huge invoice loads

- Well-connected with carriers

Cons:

- Older technology

- Limited integration with modern tools

- Reactive system

- Less flexible for custom needs

nVision Global

Global solution for big companies needing international freight support.

Best for: Enterprises shipping worldwide, needing multi-currency and compliance tools.

Pros:

- Global reach and currency handling

- Deep global freight knowledge

- Enterprise-level clients

- Strong reporting features

Cons:

- Post-shipment audit process

- Complex pricing

- Long global setup time

- Not built for real-time data

Data2Logistics

Combines freight auditing with strong reporting and dashboards.

Best for: Teams wanting analytics plus basic auditing.

Pros:

- Strong data and dashboards

- Custom reports

- Connects with many data sources

- Focus on decision-making

Cons:

- Reactive process

- Needs configuration to work well

- High data setup needs

- Doesn’t stop disputes before they happen

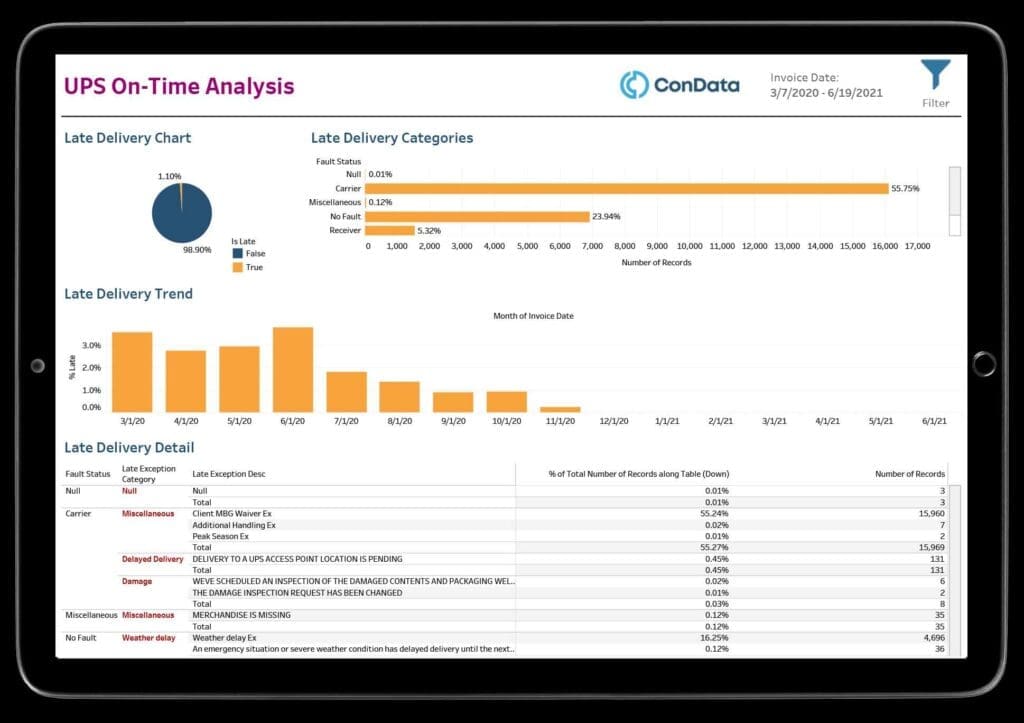

ConData

A simpler freight audit tool for mid-sized companies.

Best for: Mid-sized teams wanting basic audit tools at a fair price.

Pros:

- Easy to set up

- Budget-friendly

- Simple interface

- Good value for the cost

Cons:

- Lacks advanced tools

- Traditional audit process

- Fewer integrations

- Not ideal for fast-growing businesses

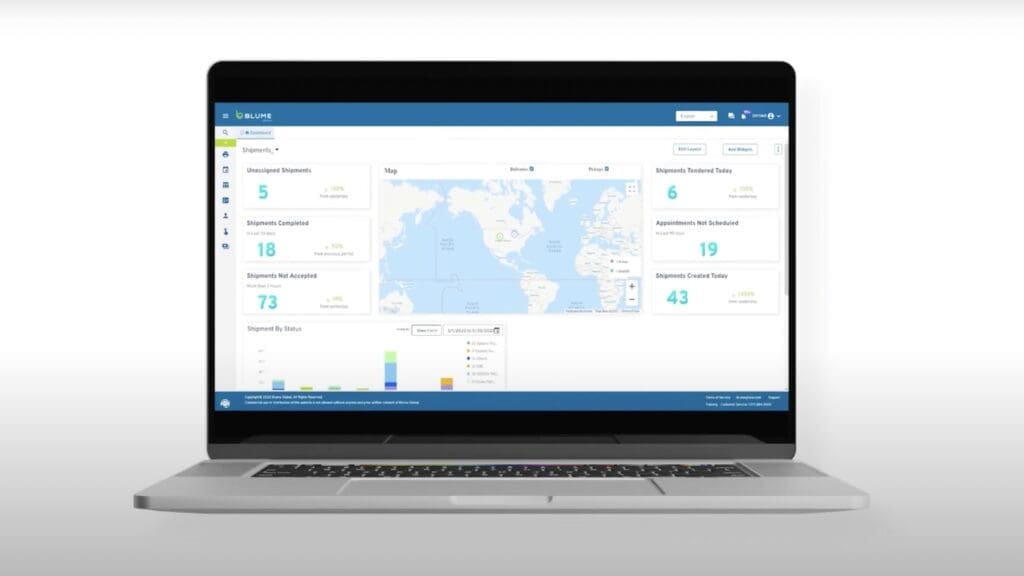

Blume Global

Offers freight auditing along with full supply chain visibility.

Best for: Companies wanting shipment tracking and audit tools in one platform.

Pros:

- Tracks freight in real-time

- Built for modern integrations

- Cloud-native

- Combines audit + visibility

Cons:

- Audit is not the main feature

- Expensive for audit-only use

- Takes time to learn

- Still uses post-shipment audit steps

ControlPay (Transporeon Freight Audit)

European-focused tool now part of Transporeon’s platform.

Best for: Companies with strong European shipping or global needs.

Pros:

- Strong in the EU market

- Ties into Transporeon’s tools

- Supports many languages and currencies

- Well-known in Europe

Cons:

- Reactive audit approach

- Weaker U.S. capabilities

- Complicated pricing

- Cross-border disputes take time

CTSI-Global

A full TMS and freight audit tool for big companies.

Best for: Enterprises wanting one system for TMS and audit.

Pros:

- All-in-one TMS + audit

- Built to scale

- Strong for big teams

- Long history with enterprise clients

Cons:

- Reactive model

- Hard to implement

- Costly

- Too complex for audit-only needs

Green Mountain Technology

Best for: Parcel-heavy shippers seeking data-driven cost control.

Pros:

- Deep parcel expertise

- Carrier optimization tools

- Strong analytics

- Strategy consulting included

Cons:

- Parcel-focused (less for other modes)

- May be too narrow for mixed-mode shippers

Orca Freight Audit

Best for: Companies wanting configurable audit workflows.

Pros:

- Highly customizable platform

- Flexible dispute resolution

- Solid reporting tools

Cons:

- Smaller market footprint

- Integration takes time

- Limited global presence

Limitations of Traditional Freight Audit and Payment (And How KNNX Can Help)

After years of using freight audit tools, I’ve seen the same problem: they all work after the fact. Even with AI, these systems can’t fix their reactive nature.

The Core Problem: Reactive vs. Proactive

The traditional approach to FAP is to review invoices after shipments. By then, it’s too late. Problems have already happened, and fixing them takes time.

- Delays: Accessorials are uncovered weeks later. Carrier staff may have moved on. Records are hard to verify.

- Data issues: Older data is harder to match. Systems purge logs. Documents are missing.

- Carrier tension: Disputes months later frustrate your partners. They expect on time payments that are accurate.

Fragmented Data Sources

Freight data comes from many places:

- TMS data – (from both the shipper and carrier because they need to collaborate to have the full and true visibility of what happened in-transit for each shipment)

- Tenders

- Bills of lading

- Delivery receipts

- Carrier GPS

- Yard timestamps

- IoT sensors

- Additional parties’ data – Ports, Customs, Freight Forwarders and others may have a piece of the puzzle too.

These tools weren’t made to work together. Traditional audit firms spend hours reconciling conflicting records.

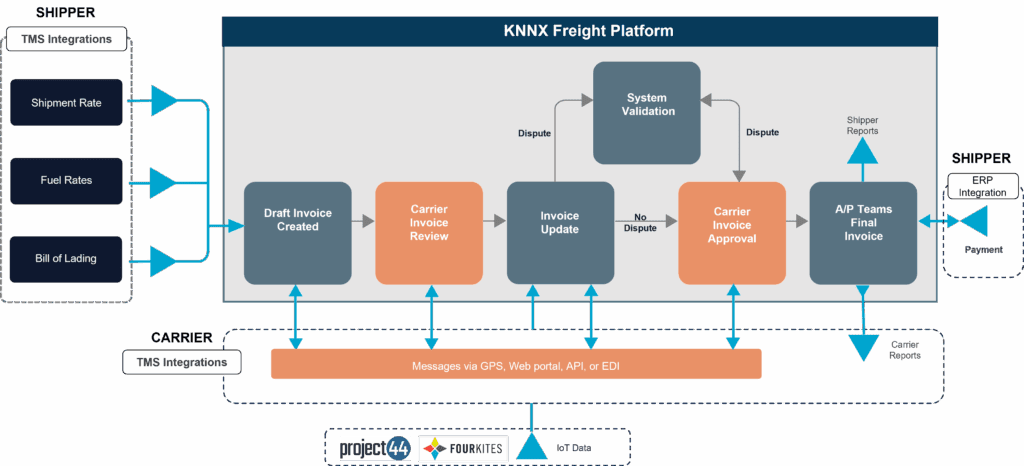

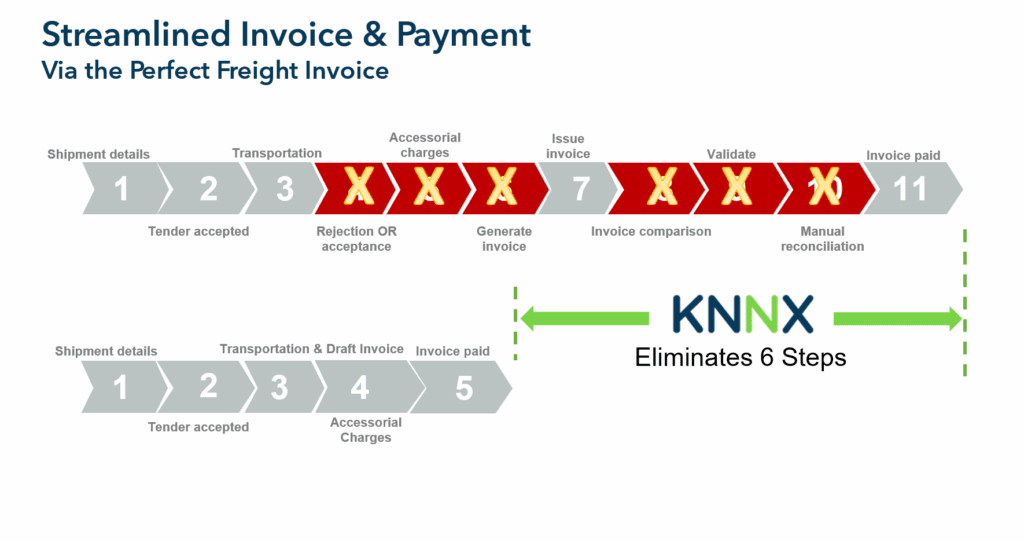

The KNNX Difference: Enterprise Transaction Assurance

KNNX changes the process by preventing errors upfront. Instead of checking invoices after the fact, it creates perfect invoices using real-time data.

How it works:

- Real-time integration: Connects to TMS, billing, ERP, IoT, and more

- Shared ledger: One version of the truth (from contracted rates, to individual shipment details) that both parties have visibility to and trust

- Error prevention: Validates data during invoice creation and in-transit, not after

- Custom rules: Business rules applied to workflow process disputes (if there are any)

Benefits of Doing Freight Audit and Payment the Right Way

There are numerous benefits to doing freight audit the right way.

Save Money

Companies save 5–15% on shipping. Here’s how:

- Catch errors before they turn into accessorials

- Mitigate fraud with more secure data and processes

- Stop overcharges

- Avoid costly invoice tolerances/thresholds

- Stop paying for 3rd party audits

Improve Efficiency

Teams save time and focus on strategy, not disputes:

- No more 60–90+ day resolution times

- Invoices processed automatically

- Far fewer exceptions to handle, and those that are raised are easily resolved because of the shared visibility and collaboration

- No need for review of third-party audit services

Get Better Data

Clean data, visible and collaborated by all the necessary parties means smarter decisions:

- Adjust routes during supply issues

- Choose optimized DC locations

- Spot carrier trends

- Improve demand forecasts

- Correct issues once because of the visibility – no more multiple invoices with the same issue next month because you’ve fixed the root cause and prevent it from continuing

Build Stronger Carrier Relationships

Carriers prefer clean processes:

- On-time accurate payments

- Fewer disputes

- Clear expectations

- Smooth, automated communication

Improve Financial Accuracy

Accurate records help your whole business:

- Better executive reports

- Clean general ledger coding

- Accurate accruals

- Fewer audit issues

Conclusion

Freight audit and payment isn’t just about checking invoices anymore. It’s a way to control your costs, improve planning, and support growth.

When picking a system, think about how complex your shipping is. Basic systems may work for small teams. But if your business is growing, modern tools will help you stay ahead.

Real-time systems like ETA platforms by KNNX are the future. They stop problems early and give you a big edge.

Choose a solution that fits your needs now and can grow with you later.

Table of Contents

Pete Gowanlock

Chief Product Officer

Pete brings over 30 years of experience in financial supply chains and fintech systems integration, with a background spanning U.S. Bank, Syncada, and now KNNX. He specializes in delivering tech-driven solutions—leveraging blockchain, IoT, and AI—to enhance trust, visibility, and efficiency across the supply chain ecosystem.